Your #Career : 6 Very Clear Signs That Your Job Is Due To Be Automated…And what about you? Are you Sufficiently Aware of the Signs that you Should? To Help you Get the Head Start you May Need, here are the Signs that it’s Time to Fly the Nest.

And what about you? As intelligent technologies take over more and more of the decision-making territory once occupied by humans, are you taking any action? Are you sufficiently aware of the signs that you should? To help you get the head start you may need, here are the signs that it’s time to fly the nest. All of them are evidence that a knowledge worker’s job is on the path to automation.

1. IT INVOLVES LITTLE PHYSICAL CONTACT OR MANIPULATION OF THINGS

If you don’t have to touch your work or see your customer face-to-face in order to perform your job, there’s less reason not to automate it. If you deal primarily in documents (as real estate and many other types of attorneys do, for example) or images (like radiologists), systems can digest that content and determine its meaning. If your job requires you to wrestle with something physical in unpredictable ways, it’s not going away very soon. An anesthesiologist friend, for example, says he often has to move patients around a lot to clear airways, so he doubts robots will put him out of work.

Like this Article ? Share It ! You now can easily enjoy/follow/share Today our Award Winning Articles/Blogs with Now Over 2.5 Million Growing Participates Worldwide in our various Social Media formats below:

FSC LinkedIn Network: (Over 15K+ Members & Growing !) www.linkedin.com/in/frankfsc/en

Facebook: (over 12K) http://www.facebook.com/pages/First-Sun-Consulting-LLC-Outplacement-Services/213542315355343?sk=wall

- Google+: (over 800K)https://plus.google.com/115673713231115398101/posts?hl=en

- Twitter: Follow us @ firstsunllc

educate/collaborate/network….Look forward to your Participation !

Continue of article:

2. IT INVOLVES ANSWERING DATA-DEPENDENT QUESTIONS

We already know that analytics and algorithms are better at creating insights from data than most humans. They have already replaced some insurance policy underwriters and financial planners. They’ll probably replace more, since this human/machine performance gap will only increase.

For example, a company called Kensho Technologies has created an intelligent software system called Warren, which can already answer questions like, “What happens to the share prices of energy companies when oil trades above $100 a barrel and political unrest has recently occurred in the Middle East?” The company stated that by the end of 2014, its software would be able to answer 100 million different distinct financial questions involving complex data.

3. IT INVOLVES QUANTITATIVE ANALYSIS

One might think that quantitative analysts would be immune from job loss in the “Age of Analytics,” but there are technologies that place their jobs at risk, too. Many quantitative analysts’ jobs will be replaced—or at the least heavily augmented—by machine-learning systems. Machine learning is probably best used to augment human analysts and improve their productivity in analysis and model development.

But in some settings, such as online advertising, it’s virtually impossible not to employ machine-learning approaches to generate models at the necessary pace. The number of models needed to target a particular consumer and a particular advertising opportunity easily ranges into the thousands per week, and the likelihood of a successful conversion (say, the customer buying the advertised product within a week) is about one in a thousand at best—meaning it’s not worth human attention. Models generated through machine learning are the only possibility in this industry and a growing number of other ones.

Of course, it takes an expert quantitative analyst to design the machine-learning approach, but one such analyst can ultimately generate millions of models over time. If you’re a quantitative analyst who understands machine learning, you may well keep your job. If you don’t understand it, you’ll probably be replaced by it.

4. CONSISTENT PERFORMANCE IS CRITICAL TO YOUR ROLE

Computers are unfailingly consistent; that’s why they already determine who gets credit in financial services, for example. Where consistency matters in other job domains—insurance claims adjusting, financial stress testing, perhaps even judging crimes and issuing punishments—computers will increasingly take on the task. In insurance claims, for example, “auto-adjudication” can automatically evaluate and approve up to 75% of claims. Human claims adjusters are left to approve only the most challenging ones.

5. IT INVOLVES THE CREATION OF DATA-BASED NARRATIVES

Jobs involving the narrative description of data and analysis were once the province of humans, but automated systems are already beginning to take them over. In journalism, companies like Automated Insights and Narrative Science are already creating data-intensive content. Sports and financial reporting are already at some risk, although the automation of these domains is on the margins thus far—high school and fantasy sports, and earnings reports for small companies.

Other companies, like AnalytixInsight, create investment analysis narratives on more than 40,000 public companies with its CapitalCube service. The job at risk in this case is that of investment analyst. Wealth management in financial services, which already relies on computer systems in many cases to determine the ideal portfolio for a particular type of investor, is also at risk. Wealth managers and brokers today often take automated recommendations and translate them into narratives for their customers. As customers grow more sophisticated and computer-literate, the translation function will be less necessary.

6. THERE ARE WELL-DEFINED RULES FOR PERFORMING THE WOR

The easiest domains to automate have always been those with clear, consistent rules. Now rule-based systems can handle increasingly complex problems. If we were training for a career in financial auditing, for example, we’d be concerned. There are already some systems that automate key aspects of auditing. In tax preparation—a job that is entirely based on following complex rules—much of the work has already been taken over by systems like TurboTax and TaxCut for consumers and small businesses, and Lacerte, ProSystem, and UltraTax for corporate returns.

Think of these as the attributes of “dodo jobs”—those that are sitting there just waiting to be gobbled up by technology. It may be that we’ll be left with fewer of them and not none; the most experienced knowledge workers in careers affected by these technologies may keep their jobs, while no new positions open up for entry-level workers. But for your own well-being, or your children’s or grandchildren’s, we’d advise you to run from them while you can.

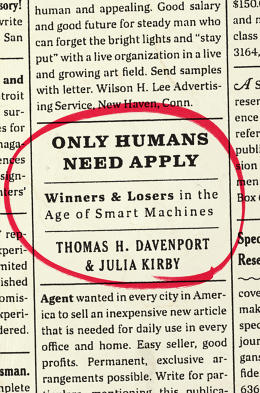

This article is excerpted from Only Humans Need Apply: Winners and Losers in the Age of Smart Machines by Thomas H. Davenport and Julia Kirby, published by Harper Business, an imprint of HarperCollins Publishers. It is reprinted with permission.